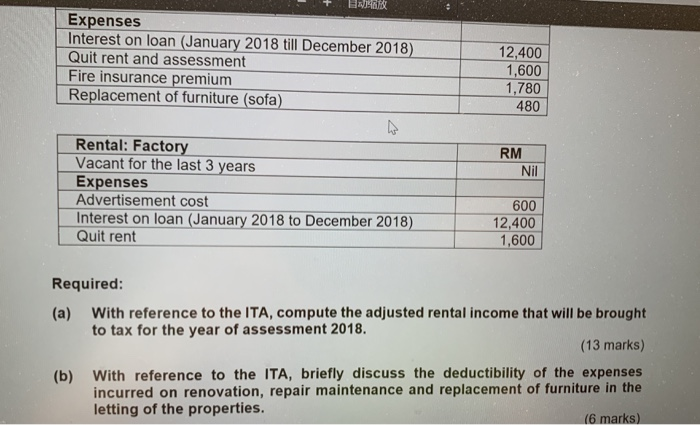

Assessment And Quit Rent

Assessment and quit rent.

Assessment and quit rent. Those who pay either tax after the due date must pay a fine. Under feudal law the payment of quit rent latin quietus redditus pl. Quit rent is a form of land tax collected by state governments via land office and is imposed on owners of all alienated land freehold and leasehold land.

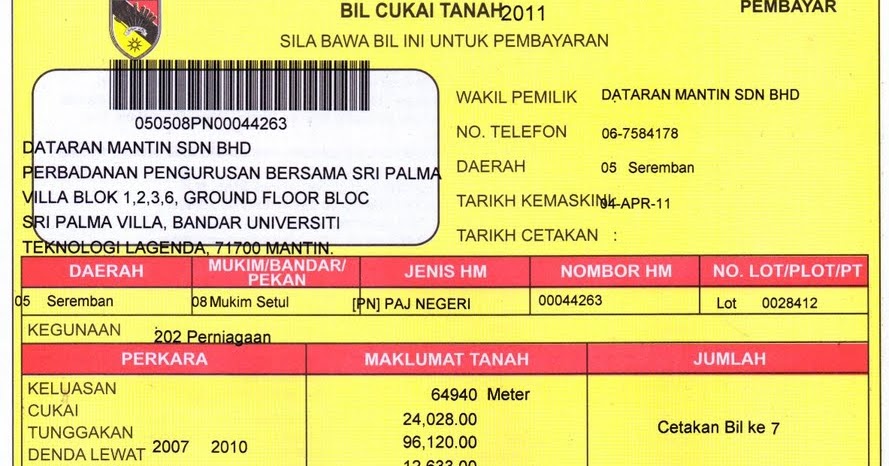

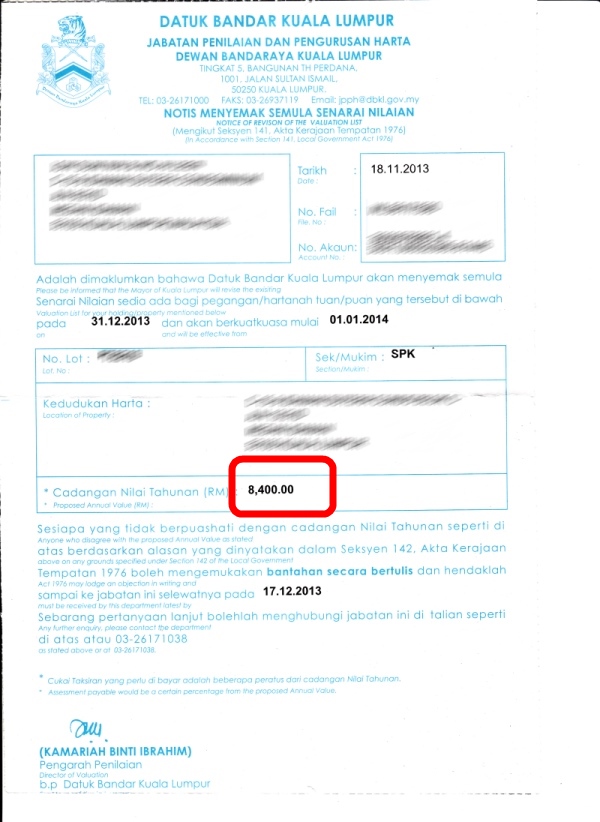

The bill is yellow in colour. It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year. Quit rent cukai tanah is a tax imposed on private properties.

Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. Quit rent is a form of land tax collected by state governments via land office and is imposed on owners of all alienated land freehold and leasehold land. Majlis bandaraya johor bahru majlis perbandaran jb tengah.

Maximum limit myr dewan bandaraya kuala lumpur. Land and property owners must known state due dates and assessment rates and act of their own volition in paying the tax. The bill is yellow in colour.

11 digit account no view sample. The tax assessment bill is blue in colour land tax is imposed to land owners and is paid to state authorities once every year. Redditus quieti freed the tenant of a holding from the obligation to perform such other services as were obligatory under feudal.

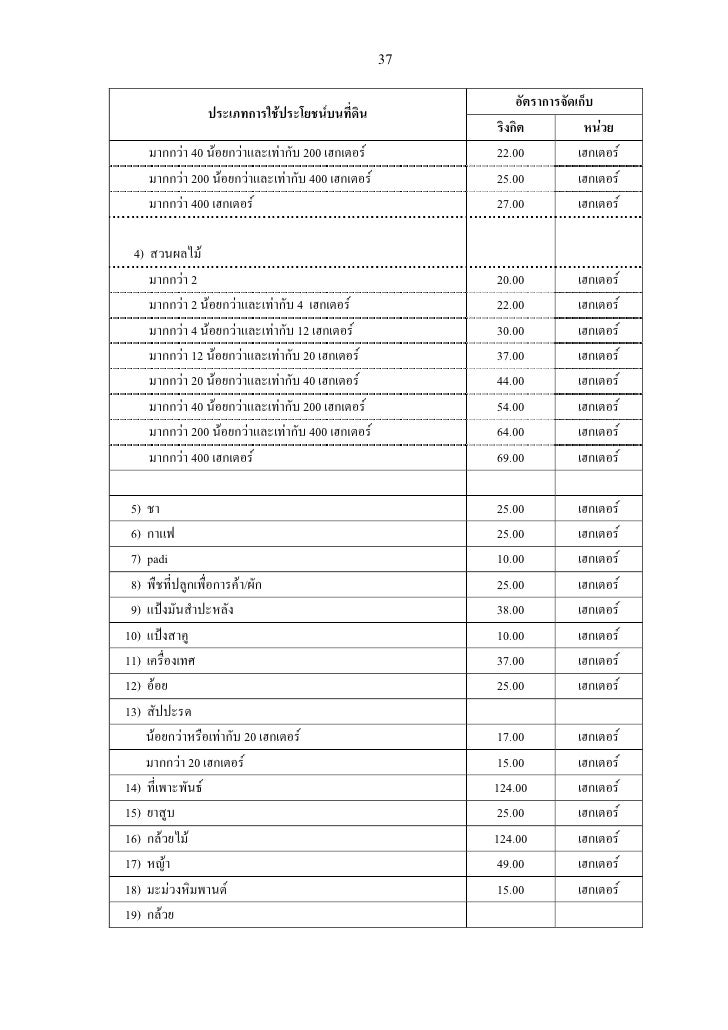

Cukai tanah is calculated at a varying rate depending on the type and size of the property that is built on the land. Quit rent quit rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. Quit rent or cukai tanah is a form of land tax collected by your state government for property in malaysia.

Quit rent and assessment tax is due by a certain date each year without demand from the government.